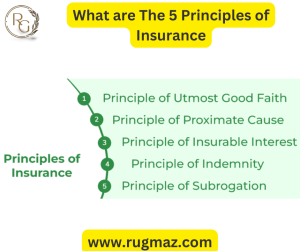

What are The 5 Principles of Insurance

Insurance is a form of protection. we’ll give an overview of the principles of insurance. Its principles are based on a policyholder’s insurable interest in the issue matter of insurance. Whether the object is owned or not is immaterial, but it must influence the policyholder’s life in some way. Insurable interests require that the object of insurance has some uses or gains. And a policyholder’s adverse effects or losses must result if the object is damaged or destroyed.

Here are the Principles of Insurance

Insurable interest

The principle of insurable interest refers to what constitutes an insurable interest. This interest must be a pecuniary or economic one. Insurability depends on the underlying interest of the insured, which could be a person, object, or event. If you own a taxicab, you have an insurable interest. If you are insurable in the event of a loss, the insurance company will cover your losses.

The principle of insurable interest applies to all types of insurance contracts. Business life insurance, for example, is a common practice. Business partners can buy life insurance contracts on each other, while corporations take out key man life insurance on key executives. Likewise, creditors can purchase life insurance policies on their debtors, as long as it is equal to the amount owed. Likewise, the law of insurable interest requires that a business owner or creditor take out insurance against his/her assets to prevent financial loss in the event of a disaster.

Indemnity

One of the principles of insurance is the holder of the insurance policy must have an insurable interest in the subject matter of the insurance contract. This interest must be real and must affect the policyholder. It does not have to be a physical property, but should provide benefits to the insured or adversely affect the insured. If the insured is harmed by a covered event, the insurer is required to pay compensation for damages in the amount of the insured amount.

A similar principle to indemnity is the principle of proportional contribution. The insurer paying the full amount will recover a proportionate amount from the other insurer. This principle of insurance aims to distribute losses as evenly as possible. It is important to understand all of these principles when you’re shopping for insurance. If you’re unsure of what to look for, here are some examples. It can be difficult to decide whether to buy insurance.

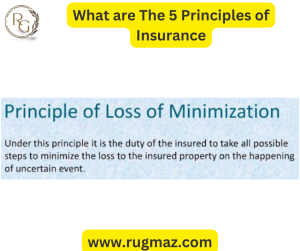

One of the principles of insurance is the principle of loss minimization. Loss minimization is an essential element of most insurance contracts and ensures good faith on the part of the insurer. It states that an insured person should take all necessary steps to limit their losses, and should minimize the damages as much as possible. This prevents the damages from increasing. And, finally, indemnity means that the insurer is not required to pay more than the amount of the claim.

The principle of utmost good faith is perhaps the most important principle of insurance. Under this principle, both parties must act in good faith with respect and honor and not seek unfair insurance or funds. A common example is the “law of large numbers”.

Mitigation

The insured must minimize loss or damage to the insured property. He must act reasonably during a period of uncertainty. Otherwise, he may lose the claim amount given by the insurer. Therefore, the insurer should not be irresponsible. He should do everything he can to protect his insured property and prevent further loss. The following principles should guide an insured when he’s seeking insurance. Read on to find out more.

First, the parties must act in good faith. They must disclose all material facts to the insurer. False claims breach the contract and result in legal penalties. Therefore, insurance companies should investigate any claim that is questionable, and should accept genuine insurance claims as soon as possible. If you feel that an insurer has engaged in unfair practices, you should contact an insurance law attorney. In many cases, insurance laws are complicated, and it’s best to consult an insurance lawyer with expertise in insurance law.

The principle of insurance contribution is often considered an extension of the indemnity principle. If an insured has more than one insurance policy for the same item, each insurer must contribute a proportion of the loss. For example, if you have two policies on the same car, Progressive and Liberty Mutual each cover $30,000 in property damage. The insurance companies will compensate each other proportionately. In this way, each insurer can avoid paying more than it has to.

Subrogation refers to the right of one party to act in another’s place. When an insured is injured by someone else’s negligence, the insurer can claim the loss and reimburse the injured party. In such cases, the insurer can stand in the other party’s shoes to seek compensation for the damages. In addition, the principle of subrogation also applies to multiple insurance policies covering the same subject matter. It is important to understand that an insurer cannot profit by claiming losses under different policies.

Loss minimization

The principle of insurance loss minimization means that the insured should take all reasonable measures to avoid or minimize the losses associated with the property they have insured. This principle is especially important when events that are unpredictably unpredictable happen. As long as the insured is responsible and doesn’t act irresponsibly, he or she should be able to salvage the property. But it’s not always that easy to follow this principle. Here are some tips to keep in mind while following this principle.

As mentioned earlier, the principle of contribution applies to multiple insurance policies. The insurer that pays the full amount of the claim can then approach the other insurers to seek a proportionate share of the loss. This principle of loss minimization emphasizes the importance of taking reasonable steps to minimize a loss after you have purchased the insurance policies. However, this principle is only effective if you take these steps after buying insurance.

Understanding the concept of insurance is a good way to avoid making a mistake. The first step is to understand what insurance is all about. In essence, it is a means of reducing risk and loss. The insurance company should do the same. Likewise, the insured should pay the insurer on time. The principle of insurance loss minimization can help a business avoid making a loss. It should be a priority in every insurance contract.

The second step is to determine the source of a loss. It is critical to minimize the loss to reduce the amount of money it costs to repair damaged property. The insurance company will reimburse you for the amount of money spent on repairs. It will also reimburse the costs of replacing items damaged by fire. In addition, it will help protect the insurance company’s reputation. But it’s not enough. The insurer has to provide the insurance company with evidence of its responsibility.

Law of large numbers

The Law of Large Numbers is a statistical concept that relates the number of events to the number of people. For example, if a coin flips over 50 times, and 20 heads are flipped, then a person should expect to get tails. This does not make sense, because the Law of Large Numbers does not support the theory that events suddenly acquire a bias. Nevertheless, it does provide a useful guideline for insurance decisions.

The Law of Large Numbers is a statistical principle that explains how insurance companies reduce their risk and charge higher premiums for certain groups of people. For example, a car insurance company ABC Ltd collects data on a variety of different groups of people and then assigns premiums to each group. Since accidents and claims from people in the same age range are likely to result in the same amount of money, it is better for the insurance company to issue 500 policies than 150.

By using a statistical model, insurers can better predict the risk involved in a particular event. By pooling risk with other people, insurers can better estimate the cost of an unforeseen event. Furthermore, because the number of people in the group is larger, the risk of the individual members increases with time. Insurers can make better predictions, and the Law of Large Numbers makes it easier to understand the risks involved.

A statistical model that uses this theory makes it possible to estimate the premiums of an unknown group. By determining how many people are involved in a certain risk, the insurance company can determine the appropriate amount of coverage. This is important as it gives the insurer a sense of how much the risk is worth. There is an underlying science behind the Law of Large Numbers that is very clear when it comes to insurance. It is very important to understand that risk is an inevitable part of life.

After reading your article, I have some doubts about gate.io. I don’t know if you’re free? I would like to consult with you. thank you.