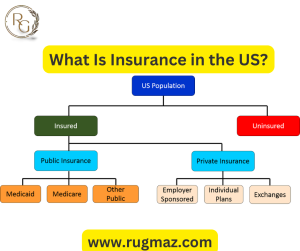

What Is Insurance in the US?

There are several different types of health insurance available in the US. Individual and family plans are designed to cover specific health risks, such as accidents or illness. Group plans, on the other hand, cover the entire family. Traditional fee-for-service plans are the most expensive and difficult to buy for low-income Americans. However, they offer the most flexibility. Read on for more information. You may be surprised at how cheap and flexible these plans can be!

Social insurance programs

The social insurance system in the United States consists of five main types of programs. In the short term, these programs provide economic security for citizens and, in the long run, they offer services that improve economic opportunities for the citizens of the country. Social Security, Medicare, Medicaid, and Black Lung are the major programs in the social insurance system.

In the fiscal year 2019, the federal government spent $2.7 trillion on social insurance programs in the US. These programs support low-income families by providing cash benefits through the Social Security program and the Railroad Retirement Board. They also provide temporary assistance through TANF block grants and the Temporary Assistance for Needy Families.

The frequency with which the benefits of social insurance programs are provided differs. Most programs provide benefits monthly, for example, such as unemployment insurance, rental assistance, and SNAP. Meanwhile, programs such as the EITC, CTC, and tax credits have historically provided benefits on an annual basis. However, these programs will begin providing monthly benefits in July 2021 and continue until the end of the year, based on an individual’s annual income.

Regarding the anti-poverty effects of social insurance programs, the Center on Budget and Policy Priorities used poverty-line thresholds anchored to the year 2019 and adjusted for inflation to calculate their findings. Among the major social insurance programs, Medicaid and CHIP were the largest recipiency programs in 2018. Unemployment insurance benefits also rose dramatically in 2020 due to increased participation by Congress. The US social insurance system should continue to improve its effectiveness for the sake of the general public.

Medicare

While there are many reasons why people get Medicare insurance in the US, there are two main reasons for full eligibility. First, a person must be a US citizen or permanently residing in the US. The second reason is to receive Social Security payments. The government has outlined specific requirements for each. If you are a US citizen and you want to receive Medicare benefits, you must meet the residency requirements. However, it is possible to qualify for Medicare insurance in the US even if you don’t meet the age requirements.

Medicaid is a federal program that makes health insurance available to people with low incomes. It is a public health insurance program that requires low-income people to meet certain eligibility requirements. The Affordable Care Act made Medicaid coverage mandatory for low-income adults, pregnant women, and children up to age 18. The program was extended in 1997 to include nearly 9 million children and is administered by the states. While Medicaid is the primary source of health insurance in the US, CHIP is a separate program that focuses specifically on children’s health.

While Medicaid and Medicare are similar in some ways, they have major differences. Medicaid is funded by the federal government and the states. It covers people who cannot afford private insurance. It can be available to people below a certain income level or to everyone. Medicare, on the other hand, does not have income requirements. Individuals can be eligible for both Medicaid and Medicare – they are referred to as dual-eligible. If you are not certain of which program you should choose, you can check out Christian Simmons’ Medicare blog, which covers topics related to Medicare.

Medicaid

The expansion of Medicaid to adult citizens has had some positive effects on healthcare costs. While the program is funded by taxes, it also provides insurance to children, who would otherwise be unable to afford medical coverage. As a result, Medicaid spending has increased more slowly than private insurance premiums and other health spending benchmarks. Moreover, Medicaid coverage has also been associated with improved self-reported health and lower mortality rates. These changes, combined with the expansion of Medicaid, have made the program more accessible to millions of people.

While the overall healthcare system has shown steady growth over the past decade, projected enrollment has seen a slow but steady increase. Medicaid enrollees are projected to increase by a modest one percent per year, from 32.5 million in 1998 to 37.6 million in 2010. Children and the disabled are projected to increase at slightly higher rates than any other group. This means that Medicaid has become increasingly important for people with health conditions who can no longer afford medical insurance premiums or cost-sharing.

There are also many non-citizens who qualify for Medicaid coverage. However, they must meet the residency requirements of the state in which they reside. If they allow, American Indians born in Canada are eligible for Medicaid coverage. These non-citizens have the advantage of receiving lower premiums and better health care than those with higher incomes. A third group that benefits from Medicaid is pregnant women and infants. This group is often defined as those whose income is up to 185 percent of the federal poverty level (FPL).

CHIP

While the eligibility for CHIP insurance in the US is not set in stone, it varies from state to state. In general, states require children to earn at least 250% of the federal poverty level to qualify for coverage. However, in New York state, the income limit has been raised to 400% or $9,250 per month for a family of four in 2022. Most states that have separate CHIP programs have modest premiums and enrollment fees.

CHIP was initially created as a ten-year program, but it required a reauthorization bill to keep the program running past 2007. Unfortunately, two reauthorization bills by President George W. Bush vetoed the first, which would have expanded CHIP. Fortunately, in the 2008 elections, Democrats took control of the White House and Congress and approved a two-year reauthorization bill that would keep the program running through 2027.

Medicaid and CHIP work hand-in-hand to cover children. Medicaid is the federal health insurance program, while CHIP is state-run. While Medicaid serves more children than CHIP, the two programs are often indistinguishable. States may design their CHIP programs separately from Medicaid, use the money to expand Medicaid, or combine both approaches. The states also receive enhanced federal funds for their CHIP programs. Moreover, Medicaid covers pregnant women, and CHIP helps people with limited incomes get health insurance.

Income support programs

The United States has a complex system of income support programs designed to fight poverty. These programs include Social Security, Unemployment Insurance, Child Tax Credit, Earned Income Tax Credit, and Temporary Assistance for Needy Families. These programs offer direct cash payments or refundable tax credits to low-income individuals and families. This helps reduce the tax burden. The federal government also provides additional funding to states to administer these programs.

Social insurance programs are designed to help people with limited resources and no other means of earning. Typically, income limits are set to a multiple of the poverty level. The federal government sets the income limit, which can range from 100 percent to 400 percent of the poverty line. In addition, some states have income limits that lower eligibility for certain benefits. Income-based eligibility for these programs is highly regulated, with income limits determined by state and federal agencies.

While federal action was essential for sustaining unemployed workers’ incomes, many states struggled to respond to the labor market crisis and federal changes. Many state systems were unreliable, especially among the Black population. In June 2020, Black men and women were only 50% as likely to receive UI benefits as whites. In fact, the UC Berkeley Center for the Study of Unemployment Insurance Programs (UCI) estimates that over half of American veterans received some type of government assistance during their lifetimes.

Group health insurance

In the US, group health insurance is health insurance for employees who are employed by the same organization or by the same company. This type of coverage typically covers 51 or more people, with some states defining a large group as 100 or more. The premiums are split between the organization and the insured parties. Health insurance coverage may also be extended to a member’s family members and other dependents. Here are some facts about group health insurance.

There are many benefits to group health plans. Group health insurance premiums are inexpensive, and members enjoy a higher quality of care and faster response times. The business itself benefits from having a group plan because it helps maintain a higher profit margin than individual plans. In addition to the benefits, group health insurance can help employers reduce tax liability. It can even provide tax deductions. Finally, group health plans can improve a company’s productivity by protecting its workers and their dependents.

The Affordable Care Act has made it easier for small businesses to qualify for group coverage. Employers with less than 50 full-time employees must meet certain requirements before they can receive coverage. These requirements include not charging people for preexisting conditions and offering an essential set of health benefits. Many small businesses may be able to qualify for group coverage with no tax penalty. However, if a business has fewer than 50 full-time employees, it is unlikely to get coverage with the federal program.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I may need your help. I’ve been doing research on gate io recently, and I’ve tried a lot of different things. Later, I read your article, and I think your way of writing has given me some innovative ideas, thank you very much.

online pharmacies canada reviews

canada drug store

online pharmacy no perscription

https://canadianpharmacieshelp.com/

canadian xanax

order meds online no prescription

mexican pharmacies online

https://canadianpharmaciesturbo.com/

mail order drugs without a prescription

medication trazodone 100 mg

synthroid online purchase

can you buy amoxicillin over the counter in australia

viagra online without prescription usa

fluoxetine hydrochloride

buy trazodone 50 mg

buy doxycycline online

silagra uk

diflucan generic price

silagra 50 mg

diflucan over the counter uk

viagra how to get a prescription

can you buy glucophage online

propranolol order

robaxin 500 mg tablet cost

zyban weight loss

metformin 2018